When you have bad credit, the path to financial recovery can feel blocked. Finding a credit card that will approve you is a huge challenge. The Credit One Bank Platinum Visa often appears as an option. It promises access to an unsecured line of credit. This means you do not need a security deposit. But is this card a helpful tool or a costly trap? This in-depth Credit One Platinum Visa for rebuilding credit review will uncover the truth behind the marketing. We will look at the real costs, the minimal benefits, and who should ultimately apply for this card.

Verdict in a Nutshell

The Credit One Platinum Visa is a last-resort option. It serves those who desperately need an unsecured credit line and have been denied for all secured cards. Its high fees and punishing APR make it a dangerous tool for most people. The primary benefit is access to credit. This benefit is often overshadowed by the significant costs.

Overall Rating:

- Best For: Access to unsecured credit with a poor credit score.

- Main Drawback: Extremely high and confusing fee structure.

- Better Alternatives: Discover it® Secured Credit Card, Capital One Platinum Secured.

What is the Credit One Bank Platinum Visa?

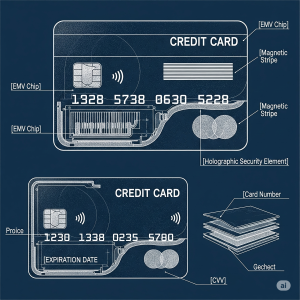

The Credit One Platinum Visa is an unsecured credit card designed for the subprime credit market. This market includes consumers with credit scores typically below 600. Its main selling point is that it does not require a security deposit. Most cards for bad credit are “secured” cards. Secured cards require an upfront, refundable cash deposit that acts as your credit line. The Credit One Platinum Visa bypasses this requirement. It offers a small line of credit based on your creditworthiness alone. This makes it accessible to people who may not have several hundred dollars available for a deposit. The card is intended as a stepping stone. It helps individuals build a history of on-time payments. This history is reported to the three major credit bureaus.

Detailed Breakdown of Fees, Rates & Features

Understanding the cost structure is the most critical part of this review. The card’s features can seem appealing on the surface. The underlying fees can quickly diminish any value you might receive. Here is a clear breakdown of what you can expect to pay.

| Feature / Cost | Details |

|---|---|

| Annual Fee | $75 for the first year. After that, it becomes $99 annually, but it is billed monthly at $8.25. This monthly billing can be confusing. |

| Purchase APR | A very high variable APR, often starting above 29.00%. This is significantly higher than most credit cards. Carrying a balance is extremely expensive. |

| Cash Back Rewards | Offers 1% cash back on eligible purchases, including gas, groceries, and services like internet and phone. This sounds good, but the value is limited. |

| Starting Credit Limit | Typically very low, from $300 to $500. This low limit can make it easy to have a high credit utilization ratio, which can hurt your credit score. |

| Foreign Transaction Fee | Yes, a fee is charged on all purchases made outside the United States. This makes it a poor choice for international travel. |

The Pros: Why You Might Consider It

- Access to Unsecured Credit: This is the single biggest advantage. If you cannot afford a security deposit for a secured card, this offers a pathway to a credit line.

- Reports to All Bureaus: Credit One reports your payment history to Experian, Equifax, and TransUnion. Consistent, on-time payments will help build your credit file.

- Pre-qualification Available: You can check if you are likely to be approved on their website. This is done without a hard inquiry that could lower your credit score.

- Some Cash Back Rewards: Earning 1% cash back is better than nothing. It applies to everyday spending categories, which is a small plus.

The Cons: Major Drawbacks to Know

-

- Extremely High Fees: The annual fee is very high for a card with so few benefits. To earn back the $99 fee in rewards, you would need to spend $9,900 in a year.

- Punishingly High APR: The interest rate is among the highest on the market. If you carry any balance from one month to the next, the interest charges will be substantial.

li>Rewards Are Underwhelming: A simple 1% cash back is not competitive. Many secured cards with no annual fee offer better rewards or a clearer path to upgrade.

- Poor Customer Reputation: The bank is often the subject of consumer complaints regarding billing issues, confusing fees, and unhelpful customer service.

- Low Initial Credit Limits: A $300 limit is easily maxed out. If your balance is $150, your credit utilization is 50%, a level that can negatively impact your score.

How it Compares: Credit One Platinum vs. Top Alternatives

A review is incomplete without looking at the competition. When you place the Credit One Platinum Visa next to top-tier secured cards, its weaknesses become very apparent. A secured card is almost always a better choice for rebuilding credit.

| Feature | Credit One Platinum Visa | Discover it® Secured | Capital One Platinum Secured |

|---|---|---|---|

| Annual Fee | $75 – $99 | $0 | $0 |

| Rewards | 1% cash back | 2% at gas stations & restaurants, 1% elsewhere. Cashback match first year. | None |

| Security Deposit | None | $200 minimum (refundable) | $49, $99, or $200 (refundable) |

| Graduation Potential | Unclear path | Automatic reviews start at 7 months to graduate to an unsecured card. | Automatic credit line reviews in as little as 6 months. |

The Final Verdict: Who Should Get This Card (and Who Should Run Away?)

After a thorough review, our recommendation is very clear. This card is not for everyone. In fact, it is suitable for a very small, specific group of people.

You might consider this card if: You have been rejected for all secured credit card options. You have zero access to any other form of credit. You desperately need a small credit line for emergencies or to establish a credit file from scratch. You fully understand and are willing to pay the high annual fee as a cost of entry. You are disciplined enough to pay the balance in full every single month to avoid the high APR.

You should run away from this card if: You can afford the minimum $200 deposit for a secured card. The Discover it Secured and Capital One Platinum Secured are vastly superior products. They offer lower costs, better features, and a clear, proven path to rebuilding your credit and graduating to better cards. For nearly every consumer, a secured card is the smarter, safer, and more effective choice.

Frequently Asked Questions

What credit score do I need for the Credit One Platinum Visa?

Credit One does not specify a minimum credit score. It is designed for consumers in the “bad” credit range, which is typically FICO scores below 600. Approval depends on your entire credit profile.

Does the Credit One Platinum Visa graduate to a better card?

There is no clear, guaranteed graduation path like there is with major secured cards. Credit One may offer you other products over time, but you may not automatically be converted to a no-annual-fee card.

Is the Credit One Platinum Visa a ‘real’ Visa card?

Yes, it is a legitimate Visa card. It can be used anywhere Visa is accepted worldwide. It offers the standard Visa protections and benefits at its level.