The chaotic gold rush phase of cryptocurrency is over. In its place, the foundational layers of a new digital economy are being meticulously laid. As we stand in the second half of 2025, the narrative has shifted from speculative frenzy to structural integration. The questions are no longer about survival, but about scale, utility, and the rules of engagement for this maturing asset class.

Institutional Integration: The wave of spot Bitcoin and Ethereum ETFs is just the beginning, signaling a structural shift in how traditional finance views and accesses digital assets.

Technological Convergence: The synergy between AI, Web3 gaming, and the tokenization of Real-World Assets (RWAs) is creating tangible use cases and value beyond pure speculation.

Scalability is Key: Layer 2 solutions are no longer experimental. They are critical infrastructure, essential for onboarding the next billion users by making transactions faster and cheaper.

Evolving Regulatory Landscape: While uncertainty remains a primary risk, clearer frameworks are emerging globally, which could both legitimize the space and impose new compliance burdens.

Redefining Value: What is Cryptocurrency?

At its core, a cryptocurrency is a digitally native asset secured by cryptography, operating on a peer-to-peer network without the need for a central authority like a bank or government. This revolutionary concept of decentralization is the bedrock of the entire industry, made possible by a groundbreaking technology: the blockchain. Think of the blockchain as a distributed, immutable digital ledger—a shared book of records that is verified and maintained by a global network of computers, making it virtually impossible to alter or cheat.

The journey began in 2009 with the launch of Bitcoin, born from a whitepaper by the anonymous Satoshi Nakamoto. It was designed as a “peer-to-peer electronic cash system.” However, the ecosystem has since exploded. We now have thousands of digital assets, tracked on sites like CoinGecko, and broadly categorized:

-

Layer 1 Blockchains: The foundational networks like Bitcoin (focused on being a store of value) and Ethereum (a decentralized world computer for smart contracts).

-

Altcoins & Tokens: These range from utility tokens that grant access to a specific service, to governance tokens that give voting rights in a protocol, and DeFi tokens that are integral to decentralized financial applications.

-

Stablecoins: Cryptocurrencies like USDC and USDT, which are pegged to a stable asset (usually the U.S. Dollar) to minimize volatility and facilitate trading.

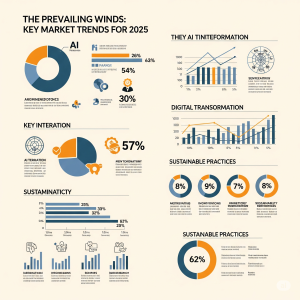

The Prevailing Winds: Key Market Trends for 2025

The crypto market doesn’t just evolve; it metamorphoses. Staying ahead requires understanding the key narratives driving capital and innovation. For 2025, the focus has sharpened significantly.

The DeFi Renaissance (DeFi 2.0)

Decentralized Finance (DeFi) has matured beyond its initial “Wild West” phase. The current trend, often dubbed DeFi 2.0, focuses on sustainability, real yield, and interoperability. We are seeing a surge in sophisticated protocols for liquid staking (where users stake assets like ETH to secure the network while receiving a liquid token to use elsewhere in DeFi), decentralized derivatives, and undercollateralized lending. Projects are moving away from inflationary token rewards and towards generating real revenue from fees, making their models more robust. For a deeper look, you can explore our guide to DeFi.

The Evolution of NFTs and Web3 Gaming

The 2021 NFT boom was driven by collectibles and art. The current wave is about utility. NFTs are now being integrated as digital identities, event tickets, loyalty passes, and key assets within blockchain-based games. The Web3 gaming sector, in particular, is a major focus. While still in its infancy, it promises true ownership of in-game assets, allowing players to trade and sell their items on open markets, a paradigm shift from the closed ecosystems of traditional gaming.

The Tokenization of Real-World Assets (RWAs)

This is arguably one of the most significant trends for bridging traditional finance (TradFi) and DeFi. RWA tokenization involves creating a digital representation of a physical or financial asset on the blockchain. This could include real estate, private equity, art, or government bonds. The potential is staggering: it could unlock trillions of dollars in illiquid assets, make them fractionally ownable and easily tradable on a global scale, 24/7. This narrative is attracting serious attention from major financial institutions, as noted by leaders in the space.

Beyond Currency: Blockchain’s Transformative Impact

To view cryptocurrency solely as a speculative asset is to miss the forest for the trees. The underlying blockchain technology is a general-purpose tool for creating trust in digital environments, and its impact is already being felt, a concept well-documented by sources like the Harvard Business Review. Its applications are reshaping major industries.

-

Global Supply Chains: Companies like Maersk have used blockchain (in their TradeLens platform) to create a tamper-proof record of shipping manifests, reducing paperwork, fraud, and delays by providing a single source of truth for all parties involved.

-

Healthcare Data: Blockchain offers a solution for secure, patient-centric health records. A patient could grant temporary, revocable access to their data to different doctors or specialists, all recorded on an immutable ledger, enhancing both privacy and interoperability.

-

Voting Systems & Governance: While still largely conceptual, blockchain-based voting could eliminate fraud and provide auditable, transparent results. On a smaller scale, Decentralized Autonomous Organizations (DAOs) already use blockchain to allow token holders to vote on key decisions for a protocol.

-

Intellectual Property: Musicians can tokenize their songs, ensuring royalties are paid out automatically via smart contracts every time the song is streamed. Photographers can create an immutable proof of ownership for their work.

The Obstacle Course: Significant Challenges Ahead

The path to mass adoption is paved with significant hurdles. Understanding these risks is as important as recognizing the potential.

The Blockchain Trilemma

This is a core challenge for blockchain developers: finding a balance between Decentralization, Security, and Scalability. Often, improving one comes at the expense of another. Bitcoin is highly secure and decentralized but struggles with scalability (it can only process about 7 transactions per second). Layer 2 solutions are the primary answer to this, aiming to provide scalability without sacrificing the security of the main chain.

User Experience (UX) and Accessibility

For the average person, interacting with DeFi protocols, managing private keys, and understanding gas fees is still far too complex. The industry’s biggest challenge is abstracting away this complexity. The goal is a future where users can benefit from the power of decentralization without needing to be a cryptography expert. Until the UX is as seamless as modern banking apps, mass adoption will remain elusive.

Regulatory Headwinds and Security Threats

The lack of consistent global regulation creates an environment of uncertainty that deters large, conservative institutions. Furthermore, while the blockchains themselves are secure, the applications built on top of them are not immune to flaws. Billions have been lost to smart contract exploits, phishing scams, and fraudulent projects (“rug pulls”). Diligence and robust security practices, which we cover in our guide to crypto security, are paramount for any user in this space.

Conclusion: The Inevitable Digitization of Finance

The cryptocurrency narrative has matured from a fringe anarchist experiment to a sophisticated, multi-trillion-dollar asset class on the radar of every major financial institution. The road ahead will be volatile, filled with both spectacular successes and cautionary failures. However, the fundamental innovation—the ability to create trust, scarcity, and ownership in a digital realm—is a force that cannot be un-invented. The future of finance is not just about digital transactions; it’s about programmable, transparent, and globally accessible value. For those who invest the time to understand its complexities, the next decade promises to be one of profound transformation.

Frequently Asked Questions (FAQ)

What is the key difference between a coin and a token?

A coin, such as Bitcoin (BTC) or Ether (ETH), operates on its own native blockchain. A token, like Chainlink (LINK) or Uniswap (UNI), is built on top of an existing blockchain, most commonly Ethereum (using standards like ERC-20).

Is cryptocurrency a safe investment for beginners?

Cryptocurrency is a high-risk, volatile asset class. It is not considered ‘safe’ in the traditional sense. Beginners should start with extensive research, read our beginner’s guide to investing, and only invest what they can afford to lose. Starting with more established cryptocurrencies like Bitcoin and Ethereum is often recommended.

What is DeFi (Decentralized Finance)?

DeFi is an umbrella term for financial applications built on blockchain networks that operate without central intermediaries. It aims to recreate traditional financial systems like lending, borrowing, and trading in a permissionless and transparent way using smart contracts.

What are Layer 2 solutions and why are they important?

Layer 2s (L2s) are separate blockchains built on top of a main Layer 1 (L1) blockchain like Ethereum. They process transactions off the main chain, which makes them significantly faster and cheaper. They then “bundle” these transactions and post a summary back to the L1, inheriting its security. They are crucial for solving blockchain’s scalability problem.