7 Stocks for Generating Passive Income in 2025

Building a steady stream of passive income is more important than ever as we step into 2025. With inflation, economic shifts, and market ups and downs, creating reliable income without constant effort can help reach financial goals faster. Investing in stocks that pay dividends can give you a dependable cash flow, even during tough times. The trick is picking the right stocks that are set up to keep paying you for years to come. This guide will highlight seven top stocks to consider for passive income in 2025, giving you a clear path to grow your money while you sleep.

Understanding Passive Income and Dividend Stocks

What Is Passive Income? Passive income means earning money with little ongoing work. It’s like having a steady river that keeps flowing even when you’re not actively paddling. Many people seek passive income to reach financial independence faster, or simply to reduce the stress of living paycheck to paycheck. Common sources include rental properties, businesses, and stock dividends. Among these, stock investing stands out because it offers the chance to earn money while holding assets that can grow in value.

Why Dividend Stocks Are Ideal for Passive Income Dividend stocks are shares of companies that regularly pay part of their profits to investors. These payments, called dividends, can be sent out quarterly, semi-annually, or even monthly. They act like a paycheck for your investments. Some companies have such a long track record of increasing dividends that they are known as “Dividend Aristocrats”, making them a reliable source of income. Historically, top dividend stocks have yielded around 3-4%, with many maintaining steady payments even in bad markets.

Key Metrics to Evaluate Dividend Stocks To pick solid dividend stocks, look at a few important numbers:

- Payout ratio: How much of the company’s earnings go to dividends. A ratio below 60% often signals stability. You can learn more about the payout ratio here.

- Dividend yield: The annual dividend divided by the stock price. Higher yields may mean higher income potential. This is a crucial metric, known as dividend yield.

- Dividend growth rate: How much the dividend has increased over time. Consistent growth is a good sign of a healthy company.

- Sustainability: Check if the company has a healthy balance sheet and good cash flow to keep paying dividends.

Reading financial statements helps you understand if a company’s dividend is secure, ensuring your passive income stays steady.

Top 7 Stocks for Generating Passive Income in 2025

1. Johnson & Johnson (JNJ) JNJ is a giant in healthcare. It owns a wide array of products, from medicines to medical devices. This diversity helps it stay strong even when markets are volatile. Johnson & Johnson has increased its dividends annually for over 50 years. That makes it a favorite for investors looking for stability and growth. In 2025, it’s still a standout choice for passive income, thanks to its consistent performance and reliable dividend hikes.

2. Procter & Gamble (PG) P&G produces everyday products like soap, toothpaste, and cleaning supplies. Since demand remains steady regardless of the economy, P&G stock offers stability. Its dividend history shows over 60 years of increases, making it a great addition for stable income streams. During economic downturns, consumer staples like P&G often hold up better than other sectors, providing peace of mind for investors.

3. Coca-Cola (KO) Coca-Cola stands as one of the most recognizable brands in the world. Its revenue is driven by a diverse portfolio of beverages, making it resilient even during tough times. KO has increased dividend payments for over 50 years. With a high dividend yield and strong brand loyalty, Coca-Cola continues to be a dependable choice for passive income in 2025.

4. Realty Income (O) Realty Income is a Real Estate Investment Trust (REIT) known for paying monthly dividends. REITs collect rent from properties like shopping centers, warehouses, and offices. They often offer higher yields because they pay most income as dividends. Realty Income’s consistent dividend payments and focus on quality properties make it a top REIT for passive income. Still, investors should watch the real estate market, which can influence future payouts.

5. Verizon Communications (VZ) Verizon is a leader in the telecom sector. With a strong customer base and ongoing 5G rollout, it offers a high dividend yield. Telecom stocks tend to be more stable, especially with steady demand for internet and cell service. While the stock faced some recent pressure, the company’s focus on expanding 5G adds long-term growth potential. Its reliable dividends make it attractive for income-focused investors.

6. ExxonMobil (XOM) ExxonMobil operates in the energy sector, which often faces swings with oil prices. Still, it has a long history of paying dividends through many market cycles. As the world transitions to renewable energy, Exxon is adjusting its strategy. For now, it remains a solid choice for passive income, especially if oil prices stay high. Investors should consider energy stocks as part of a diversified income portfolio.

7. Apple (AAPL) Apple is mainly known for gadgets, but it also returns cash to shareholders through dividends. The company’s revenue from services and other products keeps growing. Even with a modest dividend today, Apple has increased dividends several times over recent years. Including tech giants like Apple can add diversity and future growth to your income plan. Its expanding ecosystem may lead to bigger dividends in coming years.

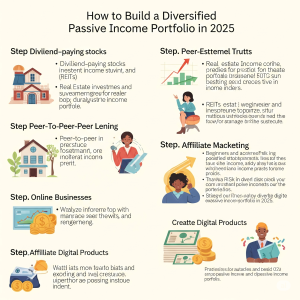

Diversification Strategies

Don’t put all your eggs in one basket. Spread your investments across different sectors such as healthcare, consumer staples, REITs, and tech. Mix stocks that pay high yields now with those that grow dividends over time. Keep an eye on your risk tolerance and adjust your investments accordingly. The goal is to create a balanced mix that can weather market ups and downs.

Reinvestment and Automatic Dividend Plans

One smart move is to enroll in dividend reinvestment plans (DRIPs). These allow your dividends to buy more shares automatically, compounding your income over time. Setting up automatic contributions helps you stay consistent, so your passive income keeps growing without constant effort.

Monitoring and Rebalancing

Regularly review how your stocks perform. If a company’s dividends look unsustainable or if your portfolio becomes too heavy in one sector, rebalance. This keeps your income steady and reduces chances of losing money. Staying proactive allows your passive income to stay on track with your goals.

Expert Insights and Market Outlook for 2025

Leading analysts expect dividend stocks to remain attractive in 2025. Inflation and economic recovery will influence markets, but well-chosen dividend payers tend to perform better during uncertain times. Keep an eye on interest rates and market trends, which can signal when to buy or sell stocks. Staying flexible and informed will give you an edge in building reliable passive income streams.

Conclusion

Choosing the right dividend stocks can make a big difference in your 2025 income plan. Stability, growth potential, and sector diversity are key to building a dependable passive income. Remember, stay disciplined—reinvest dividends, regularly review your holdings, and diversify across industries. Make your money work for you while you focus on other goals. Start today, do your research, and watch your passive income grow steadily over time.

Frequently Asked Questions (FAQ)

1. How much money do I need to start investing in dividend stocks? You don’t need a large sum to begin. Thanks to fractional shares, which most modern brokerages offer, you can start investing with as little as $5 or $10. The most important thing is to start consistently, no matter the amount, and allow the power of compounding and dividend reinvestment to work for you over time.

2. Are dividend payments guaranteed? No, dividends are not guaranteed. A company’s board of directors can decide to increase, decrease, or eliminate them at any time based on the company’s financial health and strategic priorities. This is why it’s crucial to invest in established, financially sound companies with a long history of stable or growing dividend payments, as highlighted in the article.

3. Should I invest in all seven of these stocks? This list should be seen as a starting point for your own research, not as a ready-made portfolio. The best approach is to analyze these companies further to see which ones align with your personal financial goals, timeline, and risk tolerance. True diversification often involves holding more than seven stocks across a wide variety of industries to effectively minimize risk.

4. How often are dividends typically paid? Dividend payment schedules vary by company. Most U.S.-based companies, like Johnson & Johnson and Coca-Cola, pay dividends quarterly (four times a year). However, some companies and Real Estate Investment Trusts (REITs), such as Realty Income (O) mentioned in the article, are popular for paying monthly dividends. This information is always available on a company’s investor relations website.

5. How are dividends taxed? Yes, dividend income is generally taxable. In the U.S., the tax rate depends on whether the dividends are “qualified” or “non-qualified” and on your total income level. To maximize your returns, many investors choose to hold dividend stocks within tax-advantaged retirement accounts (like an IRA or 401(k)), where the income can grow tax-deferred or tax-free. Since tax laws can be complex, consulting with a tax professional for personalized advice is always a wise decision.